Manuel Aragon – Turning Second Chances into Financial Strength

Digital Edition 2025

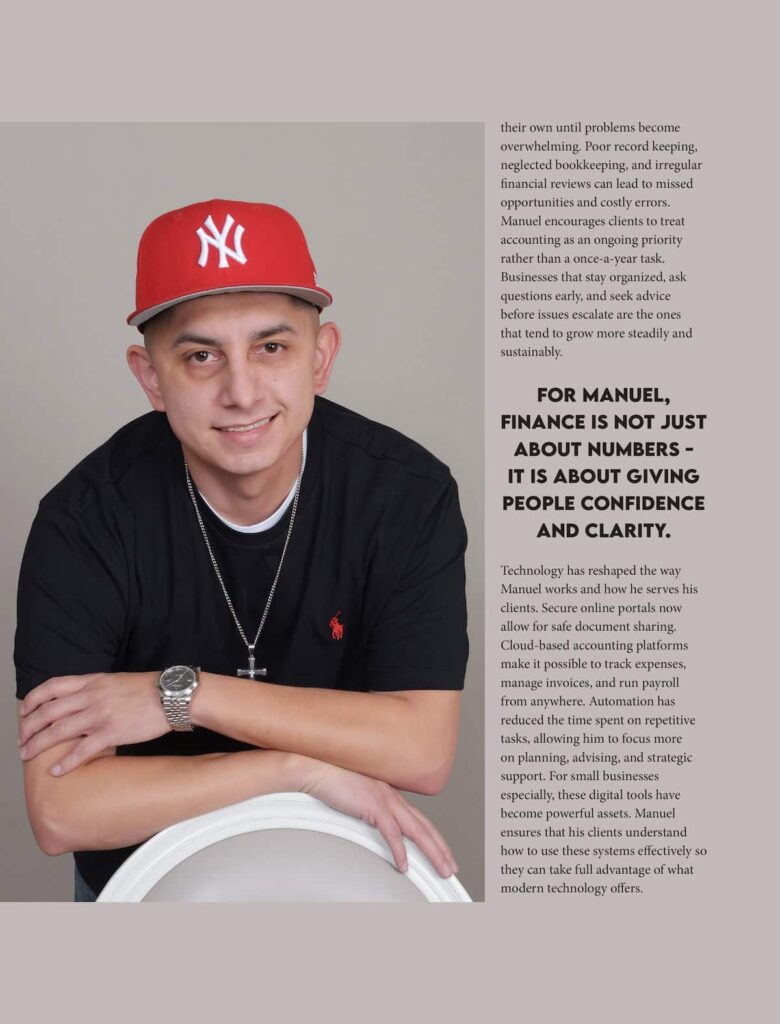

Manuel Aragon’s journey into finance and tax is a story shaped by struggle, learning, and personal transformation. He did not grow up with comfort or stability. Life presented challenges early, and as a young person, he made mistakes that carried serious consequences. These experiences forced him to learn resilience at an age when many are still finding their way. He learned what it meant to take responsibility, to face setbacks without giving up, and to rebuild even when the path forward felt uncertain. Those early years shaped his values and taught him the importance of hard work, honesty, and second chances. Rather than letting his past define his future, he chose to use it as the foundation for something better. We at CIO Global are proud to name Manuel Aragon as the Most Acclaimed Finance & Tax Expert of the Year, 2025.

After high school, Manuel made a clear decision to change the direction of his life. He wanted to rise above his past and create opportunities not only for himself, but for the people who would one day depend on him. Education became his first major step forward. He earned an Associate’s Degree in Applied Science in Accounting, committing himself to a field that demanded discipline, precision, and continuous learning. Nothing about his progress came easily. There were no shortcuts, no guarantees, and no safety net. Every achievement was earned through persistence and steady effort. Over the years, he built his expertise brick by brick, gaining hands-on experience, learning from mistakes, and growing stronger with each challenge.

As a father and financial expert, his greatest goal is to lead by example through honesty and hard work.

With more than twelve years of experience behind him, Manuel became a Certified Bookkeeper and an Electronic Return Originator. These credentials marked important milestones, but they were only part of the bigger picture. The true turning point came when he founded Aragon Tax Return Services. What began as a small operation grew into a professional service built on trust, accuracy, and personal care. Manuel built his business from the ground up with a clear purpose in mind – to help people who feel confused, overwhelmed, or burdened by financial stress. Every client he serves reminds him of where he once stood, and that connection fuels his dedication to doing honest and meaningful work.

His choice to enter the world of finance and taxation was deeply personal. Growing up, he witnessed how money problems could affect families in powerful ways. Financial stress creates fear, pressure, and difficult choices. Manuel saw how a lack of guidance and support could make things worse. As he learned more about finance and tax, he realized that this knowledge could become a tool for change. By helping others understand their money, manage their obligations, and plan for the future, he could offer the kind of support he once wished his own family had. That sense of purpose continues to guide him every day.

In his daily work, Manuel helps clients navigate complicated paperwork, tight deadlines, and confusing tax rules. For many people, taxes are a source of anxiety and uncertainty. He works patiently with individuals and business owners, breaking down each step and making the process easier to understand. One of the most rewarding parts of his work is seeing the relief on a client’s face when clarity replaces confusion. That moment of understanding is what keeps him motivated. It is not just about filing returns – it is about giving people confidence and peace of mind during a stressful time of year.

Like many professionals who work closely with small businesses, Manuel is deeply aware of the challenge’s companies face in today’s financial environment. Tax laws continue to change, sometimes quickly and with little warning. Business owners often struggle to stay informed while also managing daily operations. On top of that, many face challenges related to cash flow, client acquisition, marketing, and digital visibility. Small business owners, in particular, often wear too many hats at once. Manuel understands this pressure well because he has lived it himself as a business owner. His own experiences allow him to approach clients with empathy, patience, and practical solutions.

To serve his clients effectively, Manuel makes staying up to date a core part of his professional routine. He regularly reviews IRS updates, attends seminars, and networks with other professionals in the industry. He also follows reliable publications and keeps track of regulatory changes that could impact his clients. In a field where rules and standards are constantly evolving, learning never truly ends. Manuel believes that every new piece of knowledge strengthens his ability to protect his clients and guide them wisely. His commitment to education is rooted in his belief that knowledge opens doors – just as it once did for him.

Building his business from the ground up, he turned resilience into a lifelong profession.

Looking toward the future, Manuel sees technology and security shaping the direction of finance and tax services. Automation has already transformed how documents are processed and how returns are prepared. Clients now expect faster service, digital access, and secure communication. With the rise of online platforms, cybersecurity has become more important than ever. Manuel takes this responsibility seriously, knowing that clients place their trust in him when they share sensitive information. At the same time, he believes that no amount of technology can replace genuine human connection. While tools may change, relationships remain at the heart of his work.

Risk management and compliance are central to the way Manuel operates. He uses secure, IRS-approved platforms to protect client data and ensure accuracy. Audit protection is offered for additional peace of mind. His approach is proactive rather than reactive. He looks for potential issues early, working to prevent small problems from becoming costly ones. He is also honest about being human. When mistakes have occurred, he has taken responsibility, corrected the issue, and even refunded clients when necessary. This level of transparency has only strengthened client trust. His straightforward nature and accountability are qualities that clients consistently appreciate.

While his professional accomplishments are meaningful, Manuel considers his most important achievement to be becoming a father. Raising his son has transformed the way he views responsibility, patience, and purpose. Fatherhood has become a powerful source of motivation. Every late night, every long workday, and every challenge is met with the desire to build a better future not just for himself, but for his child. His career milestones, certifications, business growth, awards, and public recognition are all meaningful, but none compare to the pride he feels in being present for his family and setting a positive example for his son.

In addition to his work in tax and accounting, Manuel has expanded his personal and professional reach through creative projects. Launching his anthology book was a significant achievement and an experience he never imagined would be part of his journey. Being considered for a television documentary is another unexpected milestone. These opportunities reflect how far he has come and how his story continues to resonate with others. Still, despite these public moments, he remains grounded in the simple truth that real success, for him, is found in showing up for his family and living with integrity.

Simplifying complex tax matters is one of Manuel’s greatest strengths. He believes that knowledge should be accessible, not intimidating. He explains financial concepts in plain language and takes the time to ensure that clients truly understand what is happening with their money. His work goes far beyond tax returns. He helps business owners understand their bookkeeping systems, balance sheets, cash flow, payroll, and financial statements. He assists with setting up bookkeeping processes, managing payroll taxes, and reviewing financial records. By turning confusion into clarity, he helps clients feel empowered and confident in their financial decisions.

For Manuel, finance is not just about numbers – it is about giving people confidence and clarity.

Over the years, Manuel has observed several common mistakes that businesses make. One of the most frequent is waiting too long to seek professional help. Many business owners try to manage everything on their own until problems become overwhelming. Poor record keeping, neglected bookkeeping, and irregular financial reviews can lead to missed opportunities and costly errors. Manuel encourages clients to treat accounting as an ongoing priority rather than a once-a-year task. Businesses that stay organized, ask questions early, and seek advice before issues escalate are the ones that tend to grow more steadily and sustainably.

Technology has reshaped the way Manuel works and how he serves his clients. Secure online portals now allow for safe document sharing. Cloud-based accounting platforms make it possible to track expenses, manage invoices, and run payroll from anywhere. Automation has reduced the time spent on repetitive tasks, allowing him to focus more on planning, advising, and strategic support. For small businesses especially, these digital tools have become powerful assets. Manuel ensures that his clients understand how to use these systems effectively so they can take full advantage of what modern technology offers.

For young professionals entering the finance and tax field, Manuel’s advice is rooted in experience. He believes mistakes are inevitable, but growth depends on learning from them. Curiosity, consistency, honesty, and respect form the foundation of long-term success. He reminds newcomers that this profession is not only about numbers, but about people. Behind every set of financial statements is a family, a dream, or a business fighting to survive and grow. Those who listen, show empathy, and commit to lifelong learning are the ones who find both purpose and success in this career.

Balancing accuracy, deadlines, and client expectations requires discipline and structure. Manuel developed these skills through experience and necessity. During busy tax seasons, he brings in additional support to ensure that every client receives proper attention. Clear communication is essential to his process. He keeps clients informed about timelines, requirements, and progress. Whether managing tax returns, payroll schedules, or monthly bookkeeping, he follows proven systems to prevent errors and delays. The trust clients place in him is something he never takes lightly.

From a difficult past to building a trusted tax service, Manuel Aragon proves that change is always possible.

Ethical practice plays a central role in Manuel’s work. For him, integrity is not optional. It is the foundation of both business and life. He follows regulations carefully and always places the client’s best interests first. Having experienced the value of second chances, he is deeply committed to doing what is right. Transparency, honesty, and accountability guide every decision he makes. Ethical practice, in his view, is not just about compliance – it is about character.

As he looks toward the future of finance and tax consultancy, Manuel sees continued growth in automation, digital services, and data security. However, he also believes that personal connection will become even more valuable. As technology handles more technical tasks, professionals will increasingly serve as advisors, guides, and partners in planning. The true value of finance and tax experts will lie not just in calculations, but in helping clients understand their options, plan wisely, and build for the future.

Being recognized as an awardee for 2025 holds deep meaning for Manuel. It represents more than professional success. It reflects the long and often difficult road he has travelled. From a challenging childhood and past mistakes to building a respected business and helping others succeed, his story stands as proof that change is always possible. He remains grateful for every client who has trusted him and allowed him to be part of their financial journey. His message to others is simple yet powerful. No matter where someone starts, determination, honesty, and the courage to begin can open doors that once seemed impossible. For those struggling with financial stress, business decisions, or uncertainty about the future, he encourages them to seek support and take that first step forward. To him, choosing to start is the most important decision anyone can make for their future.

For more information, visit: aragontaxreturnservices.com