Bridging Finance and Technology: The Vision of Suloshini Krishna Singh

Digital Edition 2025

Suloshini Krishna Singh’s journey to becoming a CFO was not a straightforward path, but rather one shaped by experiences, resilience, and determination. Growing up in Pietermaritzburg, a small town with limited career guidance resources, she had to seek advice from professionals in different fields to understand what each career entailed. Coming from a modest background, her parents worked tirelessly to ensure that she and her three siblings received a professional education. Their aspiration was for their children to achieve more than they had. We at CIO Global, are proud to have Suloshini Krishna Singh as the Finest Female CFO of the Year 2025.

As a teenager, Suloshini explored various career options by speaking with professionals. A conversation with a doctor about the realities of the medical field did not spark much interest, as the idea of dealing with illness daily did not appeal to her youthful aspirations. However, a newly qualified Chartered Accountant (CA) painted a much more glamorous picture. He handed her the keys to his bright yellow BMW M3 and suggested that she consider the financial rewards of being a CA. This moment, albeit seemingly superficial, was a turning point for Suloshini. Her fascination with German engineering and the prospect of a lucrative career sold her on finance.

She pursued her studies at the University of Natal, Pietermaritzburg, where she earned her Bachelor’s and Honours degrees. During this time, she also met her husband, Shane. With a solid academic foundation, she moved to Johannesburg to complete her training contract at EY Inc. While at EY, she not only honed her auditing skills but also contributed to human capital development initiatives, including rewards programs and programs designed for the advancement of women. During this period, she also balanced the demands of motherhood, having her first child, Kaira.

“It takes authentic relationships to support the CFO function—no one succeeds in isolation.”

After several years at EY, where she reached the position of Senior Manager in Assurance and welcomed her second child, Raiden, Suloshini transitioned to the corporate world. She joined Nissan South Africa to manage the Internal Audit function. Here, she played a crucial role in reshaping the perception of internal audit within the company, ensuring it was seen as a business partner rather than just a compliance function. By focusing on continuous improvement and business process re-engineering, she helped integrate internal audit into the broader business strategy. Recognizing the need for direct commercial experience, Suloshini moved to the African Sales Group, where she took on a more hands-on role in accounting and earned her Certified Internal Auditor (CIA) designation. While this role strengthened her technical expertise, she found herself craving a deeper understanding of business strategy. This led her to Trudon, where she assumed the role of Head of Finance. Her time at Trudon was instrumental in expanding her business acumen.

Beyond her corporate career, Suloshini also ventured into entrepreneurship. She opened her own nail and beauty salon, successfully managing it alongside her role at Trudon. Running a business provided her with invaluable insights into operations, customer service, and financial management. However, when the COVID-19 pandemic struck, she faced a difficult decision. With lockdown restrictions making physical interactions impossible, she had to close her salon. While this was a challenging experience, it also reinforced an important business lesson: knowing when to cut losses and move on.

The pandemic was particularly tough on her family. Suloshini lost her father to COVID-19, an event that profoundly impacted her. She took time off from Trudon to focus on her family, particularly as she and her son faced significant health challenges. Despite these hardships, she remained committed to her career. She joined Flexible Packages as CFO at the height of the pandemic, a period marked by economic uncertainty. Balancing professional responsibilities with personal struggles was a test of resilience. During this time, she also embarked on the journey of completing an MBA, further pushing herself academically and professionally. The years of navigating the pandemic, coupled with her studies and professional responsibilities, tested her endurance. Yet, she persevered, emerging stronger and more determined.

“Leadership is not about being instructive; it’s about understanding, empathy, and sincerity.”

When the opportunity to join Optimi as Group CFO presented itself, Suloshini saw it as the perfect fit. While the packaging industry had its excitement, education was a sector she felt deeply passionate about. The ability to make a meaningful impact on society through her work was a driving force in her decision to join Optimi. Her journey to the CFO position was not just about technical skills but also about resilience, adaptability, and a strong support system. Her family played a crucial role in her success, providing unwavering encouragement through every challenge she faced.

As a woman in finance, Suloshini encountered numerous challenges, particularly in a traditionally male-dominated industry. Growing up in a traditional Indian household, where societal norms often dictated that women stay at home, she was fortunate to have parents who championed gender equality. Her father never treated her differently from her brothers, instilling in her a strong sense of self-worth and independence. Her husband, too, treated her as an equal, reinforcing the belief that she was capable of achieving anything she set her mind to. However, the professional world was not always as progressive. She faced gender-based discrimination in job applications, with recruiters explicitly stating that certain roles were only open to male candidates. On one occasion, a recruiter mistakenly assumed she was male due to her middle name, Krishna. Upon realizing she was female, he immediately dismissed her as a candidate. These experiences were discouraging, but they also fueled her determination.

Working in the manufacturing sector, which is heavily male-dominated, presented its own set of challenges. However, Suloshini refused to be undermined due to her gender or stature. She proved her worth through her expertise and insights, earning the respect of her colleagues. Over time, she learned to identify workplaces that genuinely valued merit over gender biases. If a company had gender-based restrictions from the outset, she saw it as a sign that they were not the right fit for her.

Balancing financial strategy with business growth involves aligning short-term financial stability with long-term scalability and profitability. It is important to define clear priorities and set SMART goals in line with strategy. Many businesses still fail to establish these fundamental goals. Investing in growth is expected, but it must be done responsibly with a strong focus on ROI. Some growth ideas may seem attractive, but it is crucial to always consider their financial return. Accurate cash forecasting is often underrated, especially in businesses with excess cash. Without proper planning, the burn rate can escalate, leading to financial difficulties. A CFO must find the right balance between cost management and necessary spending. For example, cutting costs on employee engagement initiatives can lead to higher turnover, lower morale, and lost productivity, which can be more costly in the long run.

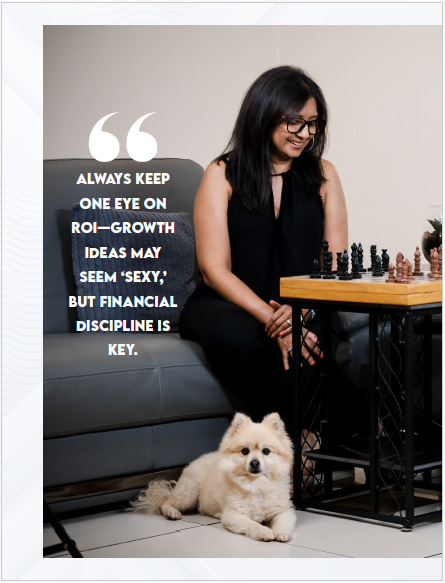

“Always keep one eye on ROI—growth ideas may seem ‘sexy,’ but financial discipline is key.”

In the South African landscape, increasing living costs and reduced disposable income have impacted education affordability. Many families are reconsidering their educational choices, leading to a shift towards vocational and skills-based education that provides direct entry into the workforce. The demand for online learning platforms has also grown significantly since COVID-19, reshaping how learning takes place. Technology plays a transformative role in modern financial management by improving efficiency, accuracy, and accessibility. Real-time data updates and remote connectivity have made timely decision-making based on facts an expectation rather than an advantage. However, financial leaders must also consider the human aspect of work-life balance to prevent overwhelming pressure on their teams.

Ensuring financial stability during economic uncertainties requires careful planning. Just as meal planning prevents unhealthy food choices, financial planning ensures liquidity management through cash flow forecasts and an understanding of revenue curves and upcoming costs. While not all uncertainties can be predicted, approaching challenges with a clear mind and teamwork helps in finding solutions. A CFO’s role extends beyond technical financial expertise. Leadership requires a deep understanding of people, empathy, and sincerity. Building strong relationships within teams and with stakeholders is essential for success. Recognizing when team members are struggling and offering support fosters a positive and productive work environment.

Mentoring and supporting other women in finance involves understanding individual career aspirations. Not every woman seeks mentorship, and it is important to offer guidance in a way that aligns with their goals. While formal mentorship is beneficial, long-term informal mentorship can also provide valuable support. Understanding personal and professional aspirations helps in providing relevant guidance and encouragement. A significant achievement as a CFO goes beyond financial metrics. One of the most rewarding experiences was when the finance team, consisting of nearly 100 people, gifted a personalized present that reflected an understanding of personal interests. This gesture demonstrated mutual respect and a strong team dynamic, reinforcing the importance of building authentic relationships while driving performance.

“If a business draws distinctions in recruitment, it’s not a place that truly values talent.”

Handling the pressure of making critical financial decisions requires reliance on data and extensive planning. Scenario planning, similar to a game of chess, helps in anticipating the impact of decisions. Consulting with others provides fresh perspectives, and being accountable for decisions—whether they lead to success or failure—is part of responsible leadership.

For young women aspiring to be CFOs, it is important to remain adaptable. Career aspirations may evolve over time, so being open to change is crucial. Planning for career growth involves identifying skill gaps early and continuously improving through a Kaizen approach. Success requires dedication, effort, and resilience, which are essential in any career path.

Suloshini Krishna Singh understands the importance of collaboration between finance and technology. Having a personal connection to the IT world, she values the role that CIOs play in driving system enhancements and digital transformation. She recognizes that many CFOs may not fully grasp the impact of technological advancements beyond their cost implications. To bridge this gap, she takes the time to learn about the benefits and timelines associated with technology. Effective communication is crucial, and she has developed the ability to translate “tech speak” into business language, ensuring that financial and technological strategies align seamlessly.

Financial innovations are an exciting area for Suloshini. The rise of AI has transformed predictive analytics, providing finance teams with deeper insights and improved forecasting capabilities. She is particularly interested in advancements in payment systems, including QR code scanning, digital payment gateways, and bill payments. These innovations have changed the way businesses receive payments and manage collections. By leveraging data analytics, she has successfully improved cash flow planning and collection strategies, demonstrating how finance and technology work hand in hand.

“Sustainable financial management is about long-term resilience, not just short-term gains.”

Looking ahead, Suloshini’s vision for the future of finance and leadership centers around empowerment, inclusivity, innovation, and ethical stewardship. The financial landscape is constantly evolving, requiring leaders to adapt and embrace new opportunities. She believes that sustainable financial management should focus on long-term resilience rather than short-term gains. Her leadership philosophy is rooted in creating an inclusive environment where diverse perspectives are valued and innovation is encouraged. Through ethical leadership and strategic thinking, she aims to shape a financial future that is both progressive and sustainable.