D. Scott Kenik – Building a Future of Security and Confidence

Digital Edition 2025

D. Scott Kenik is the Founder and Principal of Wealth Concepts Group, a national financial planning practice that focuses on one core mission – retirement preservation. He has dedicated his career to helping families protect their hard-earned savings and enjoy the peace of mind that comes from having a secure financial future. His philosophy is simple yet powerful: true wealth is not just about accumulating money, but about creating a life where one can live freely, confidently, and without financial stress in retirement. We at CIO Global are proud to name D. Scott Kenik as the Visionary Wealth Advisor of the Year 2025.

Scott began his journey in financial services in 1989. In the early years, he worked as an educator, teaching 401(k) plan design to advisors at leading firms like Merrill Lynch, Morgan Stanley, and Prudential and other national companies. His expertise in retirement plan design helped many professionals understand how to create stronger financial futures for their clients. Later, he joined Metropolitan Life, where he played an important role in launching a new retirement plan. But his entrepreneurial spirit soon led him to start his own firm, Wealth Concepts Group, where he could focus on what mattered most to him – helping families protect their retirement assets and achieve long-term financial security.

“No one will build your financial future for you – you have to do it yourself.”

His inspiration for choosing this career path came from a deeply personal experience. Watching his parents navigate retirement left a lasting impression on him. They had spent years attending investment seminars and managing their own accounts, believing they were on the right track. However, after his father’s passing, his mother revealed that they had lost a significant portion of their savings in the stock market. Despite being intelligent and proactive, they had suffered from the volatility of the market. Seeing his mother worry about making ends meet in her later years changed Scott’s perspective forever. He made a commitment to help others avoid that same struggle. The 2008 financial crash further reinforced his mission when he saw not only his own retirement account but also those of his friends and clients take a severe hit. These experiences became the foundation of his dedication to creating safe, stable, and secure financial strategies for retirees.

For Scott, being a visionary wealth advisor means looking beyond numbers and portfolios. It’s about understanding the complete financial picture of a client’s life. He believes that every individual’s and family’s financial journey is unique and requires a personalized strategy that ensures both security and fulfillment. His definition of true wealth reflects this belief – it’s about having a guaranteed income plan that allows clients to maintain their lifestyle in retirement, enjoy their passions, travel, and create memories with their families without the constant fear of running out of money. He helps families turn decades of saving into a prosperous, safe and no-stress retirement.

The guiding principle that shapes his work is safety and security. Scott believes that once people retire, their financial mindset should change from growth with risk, to protection and income. When the regular paycheck stops, savings become the foundation of stability. His role is to make sure that his client’s foundation is protected, allowing them to live comfortably without worrying about market fluctuations or losing what they have built over a lifetime.

Balancing short-term and long-term goals is another key aspect of Scott’s approach. He explains that financial planning always involves distinguishing between ‘needs’ and ‘wants.’ Paying bills, maintaining daily living standards, and healthcare are non-negotiable needs, while vacations and hobbies are important wants. His goal is to ensure that clients have a guaranteed income plan that covers their ‘needs’ so that they can enjoy their ‘wants’ without guilt or anxiety.

“When nearing retirement, you need to change your philosophy from growth with risk to protection and income.”

Over the years, Scott has made a remarkable difference in the lives of many clients. He recalls one case involving William and Shery, who came to him after consulting several other advisors with whom they did not agree. They wanted a retirement plan that provided income certainty, inflation protection, and peace of mind. Scott developed a laddered, guaranteed income plan that filled the gap between their Social Security benefits and monthly expenses. The plan used only a third of their assets, leaving them free to enjoy their dreams and support their family. With this strategy, their income was guaranteed for life, freeing them from the fear of market crashes or financial insecurity. It’s moments like these that make Scott’s work deeply meaningful.

According to him, one of the biggest challenges for wealth advisors today is combating overconfidence during long bull markets. Many investors forget about market volatility when things are going well and underestimate the risk of future crashes. Scott emphasizes that history has shown time and again how quickly markets can turn. Another challenge he faces is encouraging retirees to spend their money. After years of saving, many become overly cautious, afraid to enjoy the wealth they’ve built. His goal is to help them strike a balance – to live comfortably and confidently knowing their income is secure for life.

Scott stays ahead in his field by constantly researching new tools and financial strategies. He invests time in analyzing and comparing new products to ensure his clients benefit from the best available solutions. His curiosity and commitment to continuous learning keep him at the forefront of wealth management innovation.

Technology, in his view, has completely changed the financial landscape – both positively and negatively. He recalls the days when investors checked stock prices in the newspaper and placed trades through brokers over wired telephones. Today, anyone with a smartphone can trade stocks in real time. While this accessibility offers convenience, it also creates risks. Many investors now act on emotions rather than professional analysis, which can lead to costly mistakes. Scott believes that financial advisors, much like electricians or plumbers, play a vital role in ensuring things are done correctly. Just because someone can trade online doesn’t mean they should. Studies show that professional advisors consistently outperform do-it-yourself investors, proving the value of expertise and experience.

Trust is at the core of every relationship Scott builds. Clients place their life savings in his hands, and he never takes that responsibility lightly. His approach is rooted in education, not sales. He helps clients understand all their options, outlining both the advantages and disadvantages of each. This open communication allows clients to make informed decisions that align with their goals. To further his mission of financial education, Scott has written four financial books and produced a series of videos. His book, No-Stress Retirement Roadmap, is an Amazon #1 bestseller, reflecting his passion for helping others achieve secure and confident retirements.

When it comes to guiding clients through tough times, Scott’s strategies have proven invaluable. His clients don’t lose money in market downturns because he uses financial tools that provide stock-market-like returns with zero market risk. This protection-first philosophy ensures that retirees can maintain their income no matter what happens in the economy. His message to clients is consistent – as retirement approaches, shift focus from risky growth to stable income and protection.

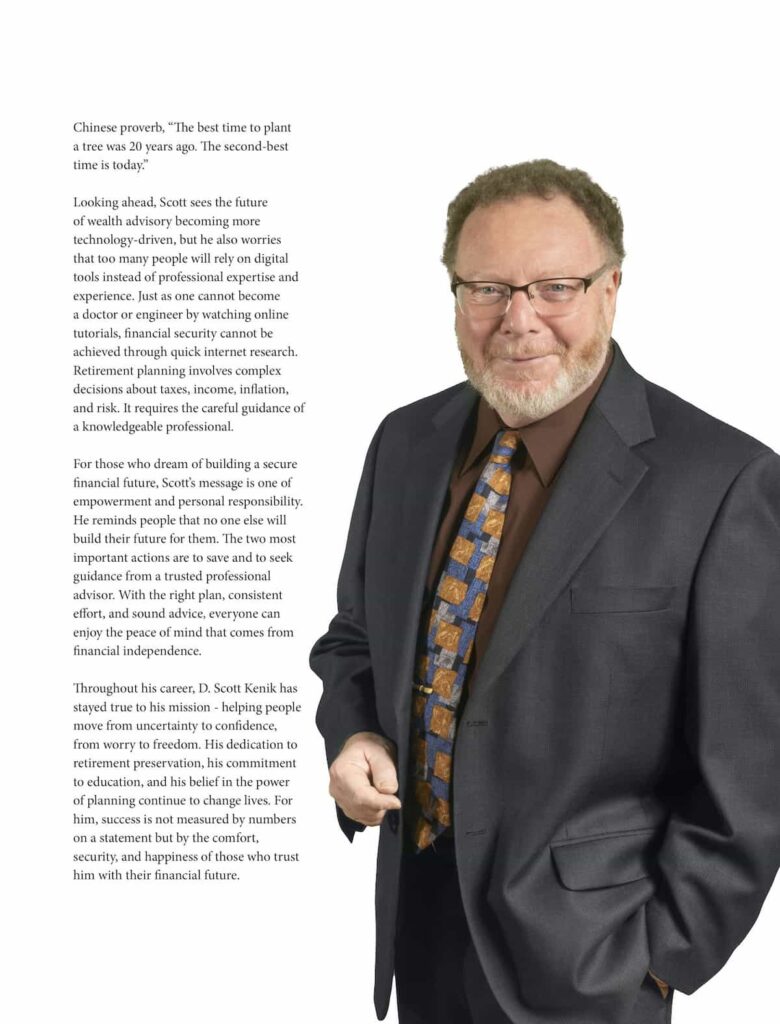

To young people beginning their financial journey, Scott’s advice is clear and practical: start saving early and save consistently. He explains that the traditional lifetime pension is now a thing of the past, and individuals must take responsibility for their own financial future. Saving at least 15% of income for retirement is ideal, but the most important step is simply to begin-regardless of age. As he often says, quoting an old Chinese proverb, “The best time to plant a tree was 20 years ago. The second-best time is today.”

Looking ahead, Scott sees the future of wealth advisory becoming more technology-driven, but he also worries that too many people will rely on digital tools instead of professional expertise and experience. Just as one cannot become a doctor or engineer by watching online tutorials, financial security cannot be achieved through quick internet research. Retirement planning involves complex decisions about taxes, income, inflation, and risk. It requires the careful guidance of a knowledgeable professional.

For those who dream of building a secure financial future, Scott’s message is one of empowerment and personal responsibility. He reminds people that no one else will build their future for them. The two most important actions are to save and to seek guidance from a trusted professional advisor. With the right plan, consistent effort and sound advice, everyone can enjoy the peace of mind that comes from financial independence.

Throughout his career, D. Scott Kenik has stayed true to his mission – helping people move from uncertainty to confidence, from worry to freedom. His dedication to retirement preservation, his commitment to education, and his belief in the power of planning continue to change lives. For him, success is not measured by numbers on a statement but by the comfort, security, and happiness of those who trust him with their financial future.